With everyone talking about the Federal Reserve this week, there is an awful lot of noise surrounding what the Fed will or won’t do. It’s at times like these where it pays to keep a bit of perspective and remember to not do anything rash.

Following are a number of charts that I have compiled from various sources that should be essential for new investors and traders alike:

1. Total returns

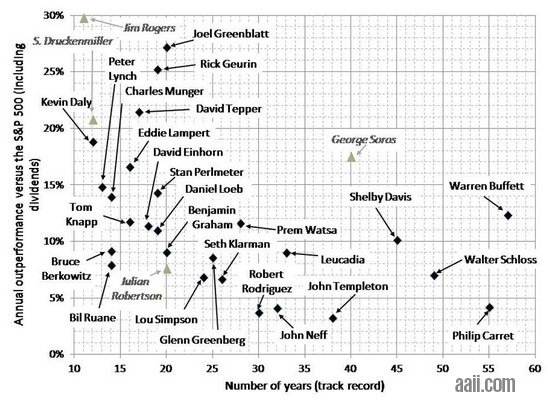

Like all good charts, this first one from JP Morgan is self explanatory. Notice how all asset classes shown performed better than the average investor? This is a clear indictment of the way most people go about investing.

They are simply not making the right decisions and therefore doing worse than the most simple buy and hold investing strategies.

The takeaway? The average investor is bad at investing. Very bad.

2. Compounding

This graphic from Kissmetrics clearly shows the power of compounding wealth and assumes an 8% annual return, compounded monthly.

The takeaway? The earlier you start compounding the better.

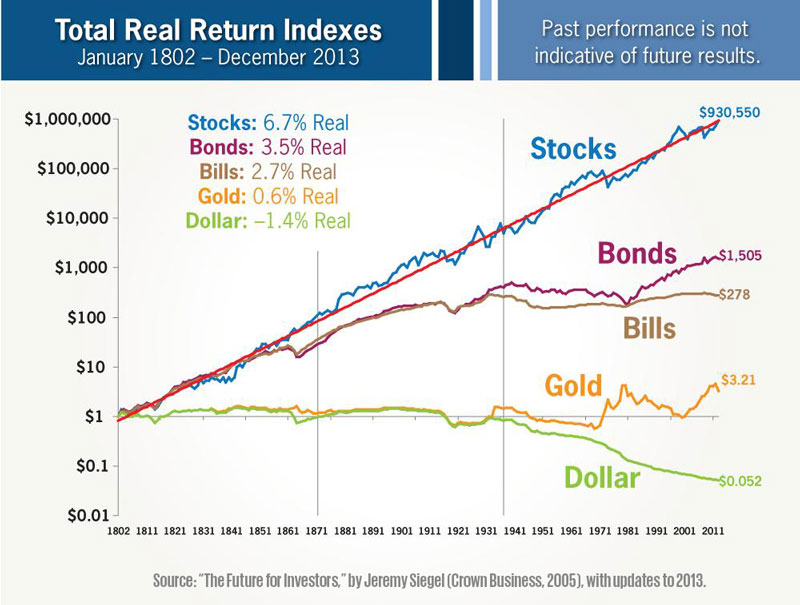

3. Total returns – long term

This is another total returns chart, this time created by Jeremy Siegel and going all the way back to 1802.

The takeaway? Over the long term, stocks are the best investment choice by a country mile.

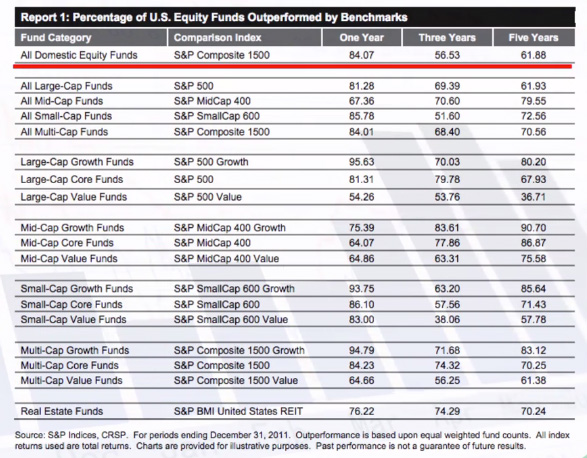

4. Mutual fund massacre

This table from Standard & Poors is updated frequently and shows how various US equity funds have performed versus the standard benchmarks. The top line shows that 62% of funds have failed to beat the benchmark S&P 1500 Index over the last 5 years.

The takeaway? You’re better with a simple tracker, than a pricey mutual fund.

5. US recessions

This fairly simple chart from dshort.com shows the US stock market since 1870 and the number of recessions along the way.

The takeaway? Recessions come along. Often.

6. Loss aversion

This chart from Trade Stops might require a little bit of explanation. If you think of the x axis as your trading account and the y axis as your state of mind it begins to make a bit more sense. The basic concept is that investors suffer more pain from losses than we gain satisfaction from winners. This is a principle touched upon in Thinking Fast and Slow by Daniel Kahneman.

The takeaway? Re-program your mind to treat losses and winners the same.

7. Diversification

Diversification is called the only free lunch in the investment world because it’s one of the only ways to reduce risk and increase return at the same time.

However, diversification only works if assets are uncorrelated with each other and this table shows the correlation between the main asset classes.

The takeaway? There are times where all markets seem to fall at once. But commodities and treasuries should provide the best diversification for stocks.

8. Bull and bear markets

This chart from Edelman Financial Services is a good one to have around to remind yourself that bear markets happen and when they do they can be vicious.

The takeaway? Bear markets are short, sharp and a regular occurrence.

9. The bull market trap

This chart was created by Dr. Jean-Paul Rodrigue of Hofstra University. It’s a classic illustration of how bull markets work.

This chart was created by Dr. Jean-Paul Rodrigue of Hofstra University. It’s a classic illustration of how bull markets work.

The takeaway? Make sure to get off before the top. And avoid the bull trap.

10. The market cycle

Another useful chart (this one from Market Folly) that shows how the market cycle tends to work when viewed according to the emotions of the crowd. If only this one had a timeline and we’d be all set.

The takeaway? Keep tabs on the crowd and remember to buy low and sell high.

11. Price inflation

This chart from dshort.com exemplifies the effect inflation can have on your money and it starts way back in 1870.

The takeaway? Don’t keep your cash under the mattress.

12. Monthly inflation

Along the same theme, this chart shows monthly rates of inflation over time. Inflation really started to become pressing after the creation of the Federal Reserve in 1914.

The takeaway? Central banks try to keep inflation at the 2% mark but it isn’t always easy.

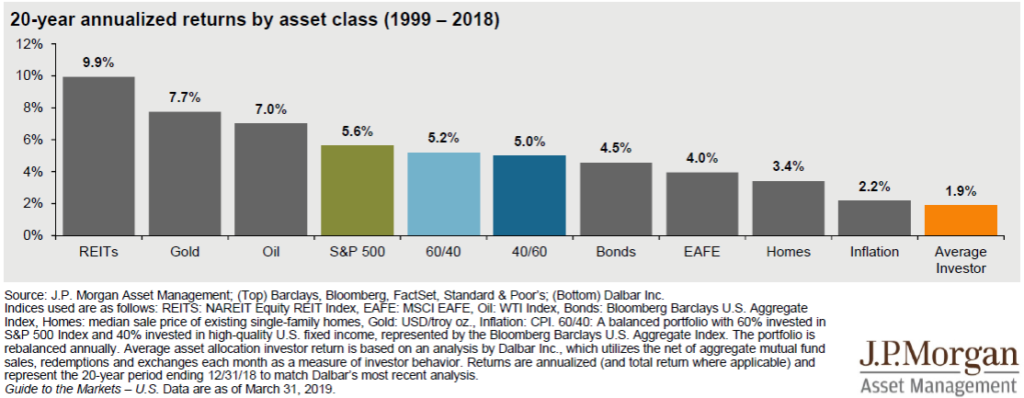

+1. The best investors.

One more for luck. Sceptics might say they got there by luck alone but this scatter chart (from AAII) shows the performance of some of the greatest investors the world has ever seen. Who’s your number one?

One more for luck. Sceptics might say they got there by luck alone but this scatter chart (from AAII) shows the performance of some of the greatest investors the world has ever seen. Who’s your number one?

Have you come across any interesting charts? Please let me know in the comments.

Here’s another interesting chart that shows stock returns versus P/E values

http://dividendmonk.com/wp-content/uploads/2012/08/shiller-pe.png

I’m going to print them all, thanks!

Great!