The term ‘quant’ or ‘quantitative trading system’ conjures up the image of a smart math graduate on the desk of an investment bank who spends their time creating sophisticated short-term algorithms. Such algorithms that pull millions of dollars from the market in a blink of an eye.

However, and though there are many of these types of quants, anyone who uses a mathematical, objective approach can also be called a quant.

So what are quantitative trading systems?

A quantitative trading system can be defined as any system that uses mathematical computations in order to make trading decisions. In finance, this is hugely beneficial for many reasons. Firstly, using a quantitative trading system means you can test your ideas objectively on past data and therefore come to conclusions about how those ideas will fare on real, future data. Some of the most successful hedge funds utilise quantitative methods to some degree. For a good example just take a look at Jim Simons whose Medallion fund has averaged 35% returns since 1989.

Secondly, quantitative trading systems can be statistically verified and tested. They can also be used to make instant, complex calculations that a human trader might not be able to.

Another advantage of using a quantitative trading system is that you can eliminate some of the human emotion involved in trading.

However, there is an important point to be made here because a trading system can never fully eliminate all of the emotion involved.

Indeed, in some cases, emotions merely get transferred to the system itself, rendering it useless.

This can happen in any number of ways; jumping on and off of the system, creating a system that it is not robust, curve-fitting the system to past data, ignoring the system or second-guessing the system’s signals…

Psychology is thus hugely important, even for quantitative traders.

Books

One good book on the subject of quantitative trading systems is Ernie Chan’s Quantitative Trading: How to Build Your Own Algorithmic Trading Business. It’s particularly good because it contains some of Chan’s original ideas. Some of these are hard to implement and require sophisticated technology but some are simple, such as Chan’s system that seeks to take advantage of earnings drift.

Another good book on the subject is Quantitative Trading Systems by Dr Howard Bandy. This is a pretty good book on how to design a trading system, and it gives plenty of examples, though it is expensive and its mainly geared to Amibroker users.

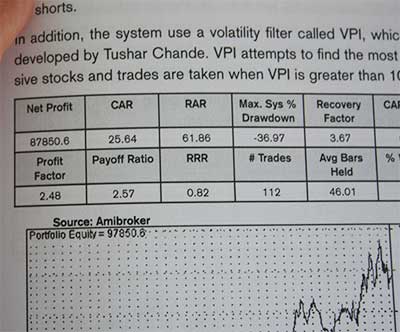

And then there is my book which contains 20 systems, all of which are tested on 10 years of stock market data and provided with a number of performance metrics. They’re a mix of trend following and mean reversion systems and are mostly based on weekly timeframes.

20 quantitative trading systems:

System 1: Moving average crossover

System 2: Four weeks up in a row

System 3: Trading the noise

System 4: Trading the noise plus shorts

System 5: Trading gradients

System 6: Dollar cost averaging

System 7: Donchian style breakout

System 8: Breakout with EMA confirmation

System 9: Trend following with the TEMA

System 10: Bull/ Bear fear

System 11: Simple RSI with equity curve filter

System 12: The range indicator (TRI)

System 13: Volatility breakout with Bollinger Bands

System 14: Trading the gap

System 15: RSI with the VIX

System 16: Trading the TED

System 17: Simple MACD with EMA filter

System 18: Cherry picking penny stocks with EMA crossover

System 19: Using the Commitment of Traders (COT) report

System 20: Finding cheap stocks with linear regression and average true range

Hi, I just buy a book from Amazon. How do I download the sample codes about the book?

Best wishes,

James

Email me your order number from Amazon.

Thanks

Hi, I also bought your book (twice by accident). The link jbmarwood.com/amazon is not working and your email adress is not mentioned anywhere. So how can I contact you?