I first published this article in 2015. I wanted to know whether the best companies to work for end up being good companies to invest in. It’s been six years so it’s time to update the data and see what it tells us.

Initial Hypothesis

My hypothesis is that companies that are voted great places to work should make better investments because it shows that employees and managers are closely aligned and working towards a common goal. Companies are simply large groups of people. The happier that group of people feel, the better the company is likely to do.

To find out, I analyzed best places to work from 2009 to 2021 according to Glassdoor and here’s what I found.

Glassdoor Data

Every year since 2009, Glassdoor publishes their list of the best places to work in the US. These companies are chosen based on criteria such as transparency, a mission to believe in, people focus, and a strong culture.

The list is published each year in January and includes both large companies and small companies. I collected data on the top 10 large publicly traded companies for each year.

Data Extraction and Cleaning

Part of this was a manual process because Glassdoor doesn’t specify which companies are public for the specific year that they receive the award. Therefore, the first step of the analysis was to go through each list of top companies and extract those that were publicly traded during that year.

Next, each company was matched to its stock symbol and data was pulled for the 1-year return following the publication date of the list. A portfolio was formed to highlight the top 10 companies’ return compared to that of the S&P 500.

Our Results

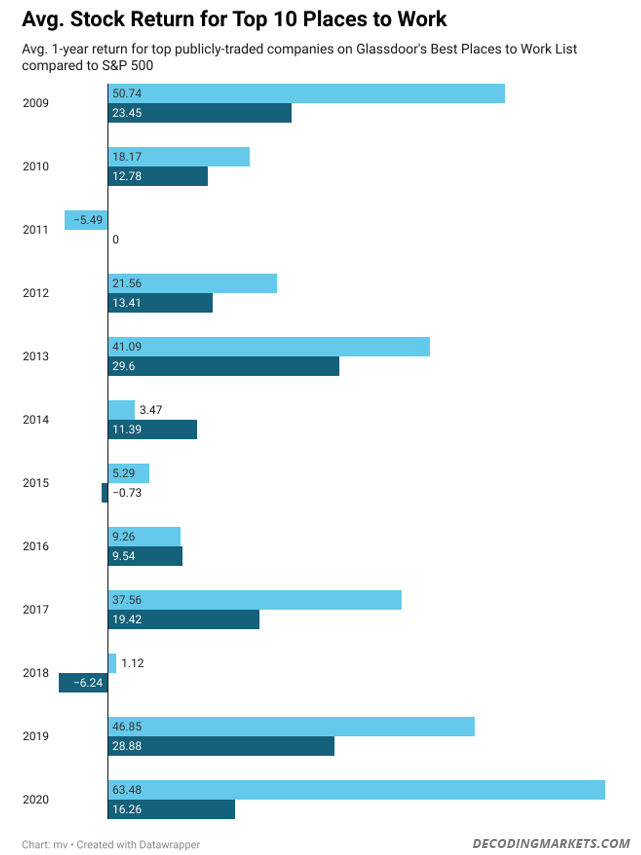

The first visualization shows the average 1-year return for all of the top 10 companies by year compared to that of the S&P500 index. The Glassdoor list is shown in light blue and the S&P 500 is dark blue.

For example, in 2009 the top 10 places to work (that were public companies) produced a 50.74% average return . Meanwhile, the S&P 500 returned 23.45%.

Based on this graph, you can see there were 3 years when the top 10 companies performed worse than the S&P 500. These years include 2011, 2014, and 2016.

However, during the other years, the top 10 companies outperformed the S&P 500 significantly. Specifically for 2020, the average return for the top 10 companies was 63%, which is a 47% improvement on the S&P 500.

Worst Year

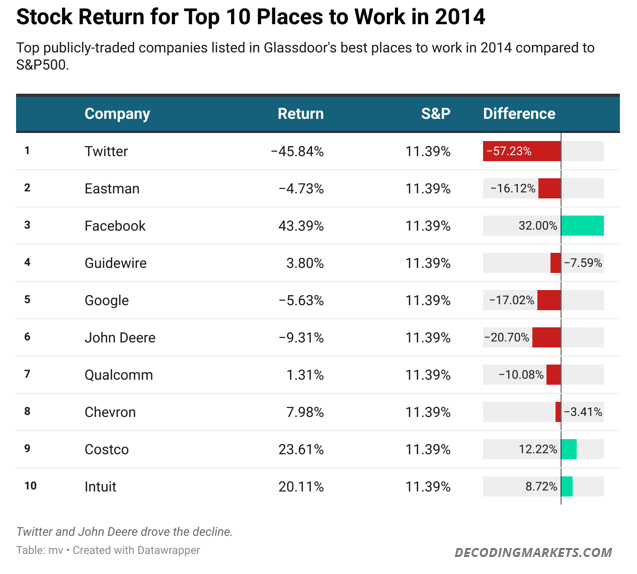

The three years when the top companies underperformed seem to warrant further analysis. Therefore, we looked at the worst performing year, 2014, which had a difference of -8.15%. We wanted to determine if a particular company was driving the drop for that year. Therefore, we graphed out the data for the top 10 companies for 2014 as shown below:

Based on this chart, Twitter and John Deere appear to be driving the significant decrease in 2014. Twitter had a -57.23% negative difference from the S&P. In addition, John Deere had a –20.7% under performance from the S&P, which contributed to the overall decline.

It’s interesting to see that there is not a significant relationship between the company’s rank on Glassdoor’s list and their return, specifically for 2014. Twitter was the #1 public company on Glassdoor’s list and it performed the worst for that year.

Best Year

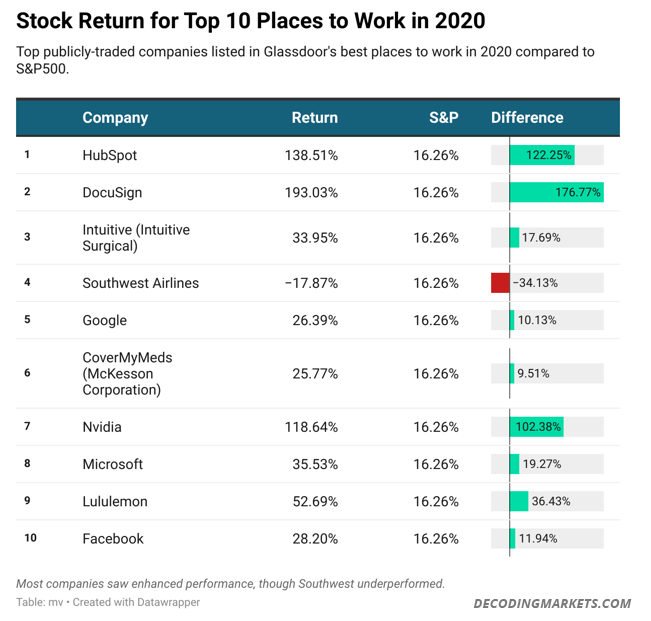

Let’s also take a look at 2020 since this year saw a significant overperformance compared to the S&P 500. Was it a specific company driving the increase, or was it a combination of good performance across the board?

The data shows that the majority of the top companies showed positive returns above the S&P 500 return. Specifically, DocuSign was up 176% and Hubspot was up 122% over the S&P 500. Southwest Airlines was the only company that underperformed the market.

I find it interesting that DocuSign was voted the second best place to work in a year where its product would see huge demand as a result of the pandemic. On the other hand, Southwest airlines performed poorly since air travel was limited during the pandemic.

Equity Growth

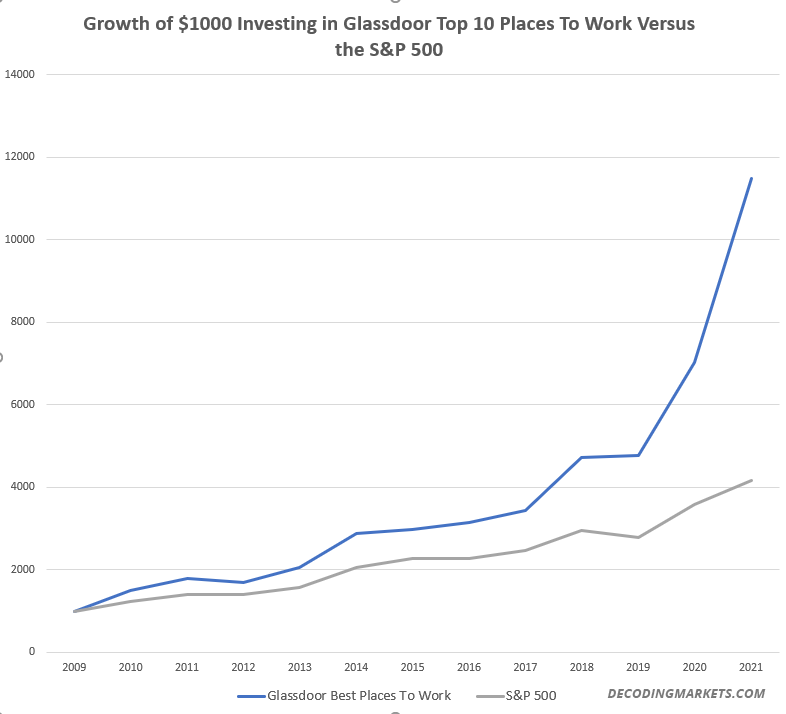

Finally we can see what it would have looked like to have invested $1000 in the top 10 public companies on the Glassdoor list versus the S&P 500 beginning in 2009:

Final Thoughts

After collecting the data and summarizing the major findings and trends, it appears the top companies on Glassdoor’s list of best places to work outperformed the S&P. However, there are some limitations to the analysis.

First, Glassdoor’s list includes companies that aren’t public therefore these companies are left out of the analysis.

In addition, this is Glassdoor’s “large company” list. It would be beneficial to conduct a similar analysis using the “small to medium company” list. It would also be useful to go through the results year by year to see if any single companies are driving the majority of gains. From what I can see, however, this isn’t the case.

There are also many other ‘best places to work’ lists that we could look at. For example Forbes or the Fortune 100 shown in this similar analysis.

Furthermore, the context for each company should be studied more closely. For instance, Southwest was down significantly during the pandemic when the airlines were down in general due to lack of travel. In addition, Twitter dropped around the time there was a log of negative press surrounding their earnings call in 2015. It is important to consider the extraneous variables impacting performance.

It would also be nice to have a larger sample. However, all being said, the data looks promising. It suggests that the best places to work do make worthwhile investments. While doing long-term equity research, this may be a factor worth considering.

If you are interested, the latest Glassdoor list for 2021 includes Nvidia, Hubspot, Google and Delta Air Lines. You can view it here.

Great post. The companies I’ve worked for, the ones that do best have always been the ones that treated it’s staff well. Might be on to something.

Thanks Renante, I have the same experience too 🙂

I’m wondering how much of the excess returns came from the days or weeks following the inclusion announcement?

I do not believe inclusion in the list would have any meaningful impact at all.

I know it used to. You would buy the list on the open after the press release and they would run up for a period of 1 or 2 weeks, it I recall. That seemed to dry up several years ago, though I have not checked recently.

Ah, I found the study. If you go to page 13 here, you can see the 10-day inclusion effect:

https://www.glassdoor.com/research/app/uploads/sites/2/2015/05/GD_Report_1.pdf

As I said, I’m pretty sure it has not worked since the paper was published, however.

Interesting, thanks.

BTW< looks like Glassdoor ran a similar analysis to yours:

https://www.glassdoor.com/research/app/uploads/sites/2/2020/04/Stock-Returns-2020-Glassdoor-Final-Reduced.pdf

Tend to suspect it all comes down from management.

2014 was during a global drought, so John Deere (and other farm equipment companies) would have been feeling the pinch enormously (we have John Deere equipment on our farm/ranch).

Twitter listed Nov 2013 and I’ve noticed a lot of newly listed companies go down before they go up. Maybe too much rah-rah in the leadup which wasn’t matched by the market?

Yes it is quite common for new IPOs to go down while founders unload shares.

Very interesting! I like the way you present information.

I tryed to replicate your results, but I get some different results.

2014 I will find below listed top 10:

Twitter TWTR

LinkedIn LNKD-201612

Eastman EMN

Meta FB

Guidewire GWRE

Google GOOG

Orbitz Worldwide OWW-201509

John Deere DE

Qualcomm QCOM

Chevron CVX

Thanks, it appears that we missed a couple of names. I will check it.