When times are good the economy is strong and everyone has more money to spend. So is there any relationship between consumer spending and the stock market?

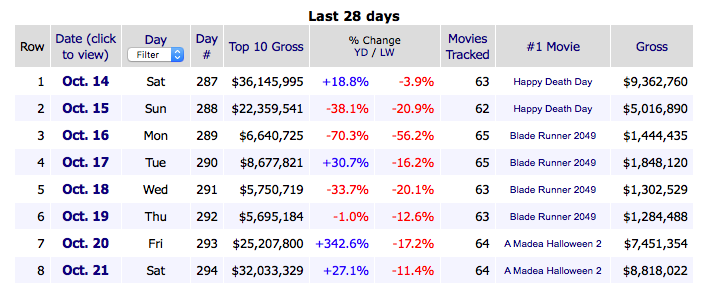

A new research paper suggests there is and provides a novel way of measuring consumer spending on a daily basis. Instead of looking at more traditional measures (such as personal income or consumer sentiment) the paper focuses on box office earnings.

More specifically, by examining how many people are headed to the cinema each week, you can get an insight into the state of the economy and use it to predict how the stock market will perform.

Following are some key findings and thoughts from the mentioned study.

Box Office Earnings And The Stock Market – Key Findings

- The study looked at weekly box office earnings for a period of 2002-2016.

- The authors constructed a model using regression analysis that uses the weekly change in box office earnings as the primary driver for stock market returns.

- They adjusted the data for seasonal effects, type, and quality of film and found a direct relationship between box office earnings and stock returns.

- They found that a one standard deviation increase in weekly box office earnings resulted in an increase in daily stock market returns of between 17.11% and 20.98% per year.

- The authors used their analysis in an attempt to predict future returns by using it as a predictive trading model. They built the model using regression analysis for the period between 2002-2007 then tested it on the out of sample data between 2008-2016.

- The trading strategy bought or sold the CRSP equally-weighted index depending on whether it suggested there would be an increase or decrease in stock prices over the next day based on the daily change in box office earnings.

- The ‘box office strategy’ returned an impressive 22.63% per annum in out of sample testing, which outperformed the index over the same period.

- There appears to be a positive relationship between increased box office earnings and stock market returns, which reflects the relationship between discretionary spending and stock prices.

- After an increase in box office earnings, there is upward pressure on stock prices for the following four days.

Some Thoughts & Considerations

(1) I found daily box office numbers can be downloaded from Box Office Mojo and the data can be used to form trading strategies. In backtesting I found a small edge trading SPY after increases in box office earnings.

(2) Box office numbers are useful because they are reported on a daily basis. Unlike many other consumption indicators which are weekly or monthly.

(3) Robust statistical methods were used in the study but traders should still be aware of data mining and curve fitting. Also, I found the data is sometimes delayed especially over the weekend which could lead to a potential lag in trading the signal.

(4) The results do show potential to use fundamental indicators to help predict movements in stock prices. Box office numbers could be used as part of a multi factor composite indicator, similar to Blair Hull’s approach.

(5) A key reason the ‘box office strategy’ is effective is that it is a reflection of the mood of investors. When investor sentiment is high they spend more money at the movies. Thus, they are likely to spend more in other areas too, such as the stock market.