I came about Motif Investing in a roundabout way. I was actually reading an article about a strategy that buys 30 different stocks each month.

I came about Motif Investing in a roundabout way. I was actually reading an article about a strategy that buys 30 different stocks each month.

One of the comments on the article was that transaction costs could eat into the system performance, unless you use a broker that is able to bunch the orders together into one transaction. And that is exactly what you can do with Motif Investing.

Motif Investing Video Review:

Motif Investing Review

Motif Investing Pros

• Just $9.95 to invest in a motif of 30 stocks

• Start with just $300

• Build motifs of stocks & create your own fund

• Get royalties from your motifs

Motif Investing Cons

• Only available to US investors

• No way yet to auto re-invest dividends

• Be careful when investing in ‘exciting trends’

Buy Baskets Of Stocks Called Motifs

If you invest in stocks, then up until now you’ve really only had two basic options. First, you can buy individual stocks – this gives you complete control of your portfolio but it can make diversification costly, as you need to buy positions in a wide range of sectors.

On the other hand, you can invest in mutual funds or ETFs. These gives you built-in diversification, but you don’t have control – you can choose a fund that invests in a particular market sector, for example, but you cannot choose the exact mix of stocks that you want.

Motif Investing is different

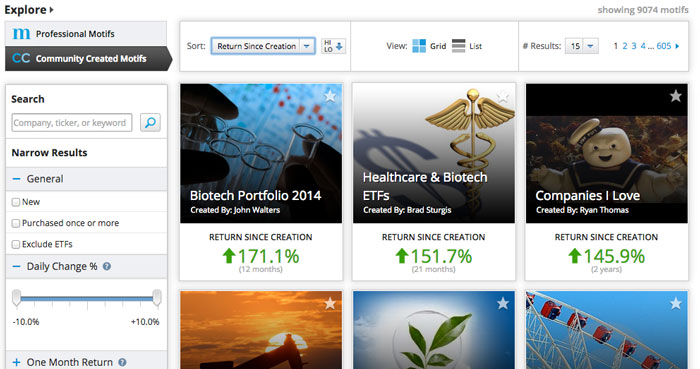

Motif Investing is looking to change all of this. Founded in 2010, the online brokerage offers what they call a theme-based investing approach. The idea is that they offer what they call motifs, which are weighted baskets of up to 30 different stocks or ETFs. Rather than buying a single stock, you buy the motif.

At first glance, this sounds a lot like an ETF, but here’s the difference – each motif reflects a single investment idea. For example, there is a motif designed to exploit biotech breakthroughs, and another that is focused on sporting goods manufacturers. Overall, the brokerage offers around 150 different motifs that they manage, and you can also create your own motif for the ultimate in control.

Build your own mutual fund

By creating your own motifs you can include any stocks and ETFs you like, up to a maximum of 30 positions. In effect, you can create your very own mutual fund. Not only can you invest in it yourself, but other investors on the site can invest in the motif that you’ve created. And you can get paid for each one that buys into your motif.

Low upfront investment

One of the main advantages with Motif Investing is cost.

If you were to buy a basket of 30 different stocks on the open market, your broker could charge $300 in fees. And in many instances you’d need at least $10,000 just to get started.

However, with Motif Investing, it costs the same to buy a basket of 30 stocks as it does to just buy one stock – $9.95. And you can start with as little as $300.

It’s worth going over again. With Motif Investing, you only pay a single $9.95 commission – no matter how much of the motif you buy. If you bought the stocks individually, you would end up paying 30 individual commissions. You can also remove or change a single stock in the motif for $4.95 each. All in all, this means that you end up paying around 3% to 4% of what you normally would pay in commissions.

The other nice thing about the brokerage is that they don’t charge any hidden fees. For example, if you are investing in a mutual fund with a similar spread of stocks as you would find in a motif, you will end up paying management fees. For an average mutual fund, this is around 1.2% of your investment every year, and even for an ETF the charges are around 0.7%. Because you don’t pay any of these management fees with Motif Investing, your effective return is significantly higher.

Sometimes you will end up with fractional shares, but the point is that you can dip your toe in the water of a particular motif without making a large investment to start. Not only that, but the motif is weighted, so some stocks can carry more weight than others. And you can adjust the weighting to your own requierements. For instance, one stock could make up 14% of the motif, while another stock only accounts for 1%. To achieve this sort of weighting buying individual stocks, you would probably have to invest $25,000 or more.

You can see the full breakdown of fees here.

Best execution

Another thing to be aware of with this type of service is execution. It’s all very well having low commissions but if bid/ask spreads are unusually high then this could negate any saving.

In this regard, Motif is audited by the regulators to verify that the firm is in accordance with best execution and this is the same as with any other main street broker. Most stocks and ETFs listed on Motif are listed on the NYSE or Nasdaq so there shouldn’t be too many issues with high spreads. Nevertheless, it’s important to take a look at how the motif has been constructed. This will show you the stocks that make up the motif and the weighting and this will allow you to avoid illiquid shares.

And as mentioned already, it’s important to keep re-balancing to a minimum. Although the fees are low they can add up if you start modifying the motifs on a regular basis.

Investment security

Of course, with this type of investment approach, another obvious concern is how secure your money is. Because you are buying motifs rather than actual stocks, are you exposed? The good news is that Motif Investing is a member of the Securities Investor Protection Corporation (SIPC), which means that your securities are protected up to $500,000. In addition, the brokerage carries additional insurance with Lloyds, providing additional aggregate protection of $150 million. The brokerage was also originally backed by Goldman Sachs, which was one of several investors who funded the business. While Goldman Sachs’ involvement does not represent any additional guarantee, it nonetheless shows that the brokerage is highly reputable.

Other reasons to look at Motif Investing

Aside from a unique investment model, low upfront investment and low costs, there are also a number of other factors that make Motif Investing highly attractive.

First, they operate an extensive in-house social network. This is a great way of sharing investing ideas with other members, and you can also invite friends from other social networks, such as Facebook. Social media is becoming an increasingly important component of online trading, and Motif Investments does a great job of making this work to your advantage.

Second, if you invest in one of the pre-defined motifs, the brokerage will actively monitor it to see when it needs to be rebalanced. While they won’t rebalance without your go-ahead – and you should only rebalance once or twice a year – if you do decide to rebalance, then it’s only going to cost you $9.95. Again, compare that to an actively managed fund, where you end up paying a significant monthly fee for this sort of service.

Get paid

And the other part of this is the Motif royalty program, which pays you $1 for every time someone invests in the Motif you created. So if you created a motif of 30 small cap stocks or 30 Internet companies, you can offer it to other investors and get paid for every time they invest.

According to these five tips for building a motif, it’s a good idea to start with a theme or trading strategy, something you are familiar with, then diversify it and give it a snappy title. That will make it the most appealing to other investors.

Are there any downsides?

In truth, there isn’t much to complain about. The only potential issue is that they do not reinvest dividends automatically, which may not fit well with your trading approach. Dividends will simply get paid out into cash into your investing account and you can then re-invest them manually.

However, if you do prefer cash dividend payments, then the brokerage will suit you well. They even have specific motifs focused on dividend-paying companies, so if you want to generate a regular stream of cash, then these are definitely worth a look.

Another problem is that Motif Investing is only available to US investors at the moment so here’s hoping the company will address that in the near future.

Summing it up & a final word of caution

The concept behind Motif Investing is excellent and it’s a concept that I am truly excited about. Creating diversified baskets of stocks for such a low cost should be useful for all types of investors. However, there should be a word of caution attached.

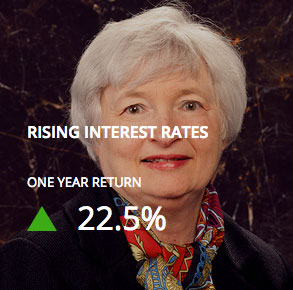

While Motif Investing is ideal for diversification purposes, many of the motifs offered on the site are anything but diversified. Buying a basket of stocks tied to a certain idea or theme (such as deflation, 3D printing, biotech, clean energy) may sound seductive but it’s also potentially dangerous. In short, there’s more to investing than just latching on to the next exciting trend – doing so can be a risky path, especially for beginner investors who don’t know what they are doing.

That being said, Motif Investing offers a unique model that makes it easy to invest in specific niche markets – making it a great secondary investing platform. The combination of low investment minimums, low commissions and no management fees make it easy to get strong diversification within the niche you choose – without having to risk large amounts or have your profits eaten up by brokerage charges. Motif Investing is a great way to build your own mutual fund and is ideal for investors with smaller account sizes.

For that reason, it gets 5 stars from me.

Overall Rating:

The video review above is also included in my trading tools course which you can get for free here.