“What an absolute piece of junk…”

“It’s mind boggling how inept this is…”

“What the heck is he doing?”

“It’s complete madness.”

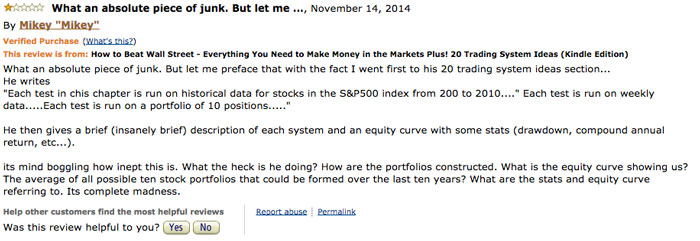

Not my words, but the words from a recent Amazon review of my book, How to Beat Wall Street and, sadly, accompanied with my first 1-star rating!

For those interested, here’s the review in full taken from the Amazon site:

I suppose one of the great things about having a blog is that I get to write whatever I want, so having the opportunity to respond to negative reviews like this one is quite good.

What to make of the review? My response.

Well, it’s never nice to receive a bad review, particularly when it’s about something that you’ve put so much time and energy into. But I suppose I should thank the reader for pointing out an issue that I wasn’t aware of until now.

It’s clear from the reader’s comments that he did not quite understand how the portfolios in the book are constructed. This is my fault. I took another look at the chapter in question and I must admit I really wasn’t clear enough about exactly how the systems work. I said that the systems are run on a portfolio of 10 stocks which isn’t clear.

I guess when you’re used to building a certain type of system you sort of take it for granted that people will understand what it is you’re doing.

Fortunately, and thanks to the power of ‘print to order’, I have now updated the chapter in question in a couple of places which I hope makes it much more clear for everyone.

(Unfortunately for me, I actually lost my book design files shortly after publication, so making any larger additions than this will be a tall order – not to say it isn’t possible).

Grievances

If I do have some grievances about the review, it’s that the reader seems to have judged the whole book on the basis of one chapter.

When I put the book together I was conscious of the fact that some readers might buy the book only for the trading systems inside. But as I have said before (and as the title conveys) these are trading system ideas.

Going into the exact details of every one of the 20 trading systems would make for a very long (and probably tedious) book indeed.

Disagreements

I guess what most irks me about the review, is that I try and be as transparent as possible. And I would have been more than happy to answer this reader’s questions regarding the construction of the portfolios.

I know for a fact that there are many published trading books out there retailing for $40+ which contain far more simplistic trading ideas than provided in my meager $3.99 book!

But alas, I now have my very first 1-star review, and like many (much more famous) writers before me, I know how it feels!

You wouldn’t be doing your job if everyone on the interweb liked you JB 🙂 Keep up the good work.

Thanks Mike!

JB Marwood. You are a thief and a swindler, give me back my money.

The reviewer is a over-the-top with his criticism. I’ve read most of the book. The trading system part is light-weight but then there are whole books out there just on trading system development so it’s no surprise that in a small e-book, the content is limited. The other parts of the book are good introductions. Further, through your courses (even a free one!) and your blog posting, you continue to enrich your ecosystem and help your readers. Well done JB!

Thanks DrG. It’s true, I could have taken just one of the trading systems and written a whole book about it, but that wasn’t the purpose. Thanks for your comment. 🙂