This week we have seen a mini crash in the stock market indexes and an implosion of several short volatility ETNs. Mood in the stock market has quickly turned from exuberance to fear while some investors are ready to ‘buy the dip’.

Conventional wisdom suggests that the best time to buy stocks is when there is blood on the streets. Many suggest that high Vix readings are a good indicator to increase exposure to the market.

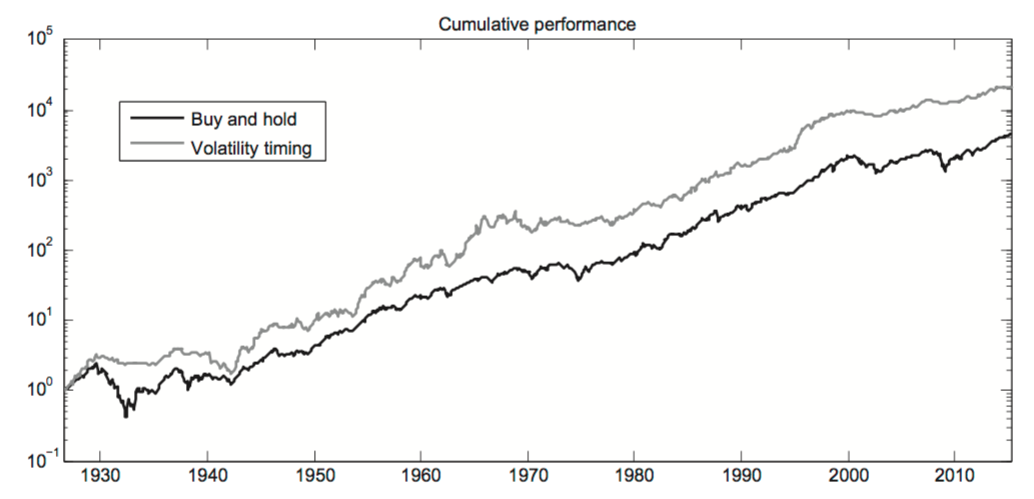

However, at least one piece of research says that this isn’t necessarily the case. In Volatility-Managed Portfolios, Moreira and Muir show that it is better to exit the market when volatility is rising and then get back in when volatility is falling.

Doing so provides better Sharpe ratios because it takes less risk in recessions but still generates high returns.

When To Sell And When To Buy

The basic premise of this strategy is to decrease exposure when volatility rises and increase exposure when volatility falls.

The strategy rebalances monthly and was shown to sail through the great depression period, 1987 crash, dotcom bubble and 2008 credit crunch.

Thus, the strategy would suggest to reduce exposure at the end of the month instead of buying into this particular dip.

Unfortunately, the rules of this strategy are more complicated than they seem at first glance and seem to rely on the inclusion of factors from Fama & French.

As noted in this article, there are some question marks over the strategy implementation for average investors.

A More Simplistic Example

Seeing as the volatility managed portfolio is somewhat complex I thought it would be interesting to look at a more simplified example.

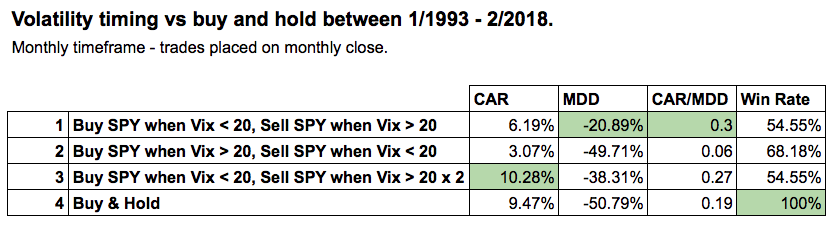

Thus, the following table shows the results of three different strategies versus buy and hold:

In the first strategy we buy SPY at the end of the month when Vix is under 20 and we sell at end of month when Vix is over 20. In the second strategy we do the reverse.

The third strategy is the same as the first but we buy twice as many shares using leverage.

You can see that buying SPY when volatility is higher (Vix is over 20) yields the worst result (blue).

Buying SPY when Vix is under 20 (yellow) gives more return for a smaller drawdown (only -21% without leverage).

In other words, we are getting a similar conclusion – that it is better to increase exposure when volatility is falling and get out when volatility is increasing.

The best return is made when we buy SPY when the Vix is under 20 and sell when it moves over 20 and combine in it with leverage (red).

The jury is still out as to whether this strategy is any better than a simple buy and hold (green), however.

Final Thoughts

Timing volatility can be just as tricky as timing the market. In my view there is a case to be made on both sides.

Reducing exposure as volatility picks up is prudent so long as you can get out early enough and definitely not at a market bottom like 1987.

On the other hand, increasing exposure when the Vix is high has also proven to be a decent strategy in other studies. In fact, several strategies in Marwood Research take such opportunities to buy market dips.

The crucial difference is that these strategies only look for very short term rebounds. They are looking to capture the pullback in an oversold market (like an overstretched rubber band) and typically last only a couple of days. Thus, they are not usually looking for a return to all-time highs.

Overall, there are different ways to measure volatility and incorporate it into your analysis.

The real conclusion is that any uptick in volatility must always be taken seriously and not just as an excuse to buy the dip.

XIV Implosion

Two casualties of the recent mini crash were XIV and SVXY. These exchange traded notes were designed to give investors a way to short Vix futures. They produced great returns for 7 years until they blew up.

Funnily enough I didn’t consider that these ETNs might go to zero. But I did warn back in October that shorting volatility at such low levels was akin to picking up pennies in front of a steamroller:

These products simply needed the Vix to spike about 100% and they would go bankrupt by design. And when the Vix has been so low for so long, this was not a small chance.

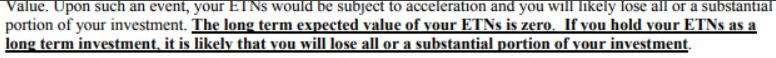

In fact, the prospectus from Credit Suisse spelt it out in clear print (albeit on page 193). “The long term expected value of your ETNs is zero.”

This is the reason why our own volatility strategy uses options (not ETNs) and is very selective with entries.

Once again, the lesson is to know exactly what you invest in before you jump in. Read the prospectus and the small print. These guidelines from Finra are good to get up to speed with some of the leveraged notes available.

—

Charts produced in Amibroker with data from Norgate Premium.