The Federal Reserve kept interest rates at near-zero on Wednesday once again. Rates have remained at record zero levels for the last seven years. This was the official line from the Federal Reserve press office:

“To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that the current 0 to 1/4 percent target range for the federal funds rate remains appropriate.

In determining whether it will be appropriate to raise the target range at its next meeting, the Committee will assess progress–both realized and expected–toward its objectives of maximum employment and 2 percent inflation.”

However, the key part of the Federal Reserve statement on Wednesday was not what was included, but what was excluded. Head of the Fed Janet Yellen, dropped previous warnings surrounding the health of the global economy and as a result, significantly raised the prospect of a rate hike coming in December.

For the first time, the Fed are now actively talking about raising rates instead of maintaining near zero levels, and the inclusion of the ‘next meeting’ sentence makes a December rate rise a much stronger possibility.

Interest rate hikes are bearish?

Just a slight change in wording caused the markets to quickly price in a sooner than expected rate hike and got traders shouting out the words ‘hawkish‘, and in some cases ‘bearish’.

But here’s the thing. Despite the hawkish tone, the stock markets ended up moving sharply higher. Yes, they dropped on the initial news, but they retraced those losses pretty quickly after they read the accompanying guidance.

So what is happening here? Aren’t we told that rate hikes are bearish for stocks? And wasn’t part of the reason the stock market dropped over 10% last month due to the prospect of rate hikes in October?

Well, yes. The common wisdom suggests that hawkish events are bearish for stocks and bullish for the dollar. But as we see time and time again, financial markets are not so predictable and there is a lot more to it than that.

Fed raise rates and stock markets rally

Usually, a rate hike is seen as bearish for stocks and a rate cut is seen as bullish. In the financial crisis, when the Fed moved to slash interest rates near to zero, the stock markets soared immediately higher. However, this was against the backdrop of a deteriorating economy and it wasn’t long before equities resumed their downward plunge.

This time, we see the Fed raise the prospect of taking away the monetary stimulus that has kept markets afloat for the last seven years and yet the stock market still manages to grind higher.

So what is going on?

Well, it’s all about expectations, the economy, and credibility.

You see, when the Fed raise the possibility of a rate hike, they are de-facto stating their confidence in the economy. Ultimately, this is a bullish message, because a growing economy is good for everybody.

Secondly, more often than not, the market knows what’s best for it. If the market goes down on a policy move, it’s usually because the market thinks it’s a bad decision. And one thing that the market hates more than anything is uncertainty. A clear and decisive message from the Fed removes uncertainty and makes the bank look more credible.

Ultimately, it seems now that the market is comfortable with slightly higher rates. In order to combat inflation, rates need to go higher eventually and the market knows that. So a clear and direct message is bullish for stocks. Looking at the reaction, there is little to suggest that we will not break out to new highs once again now.

Not only that, but the market is aware that the first rate hike will be so small that it will have only a negligible effect on the economy.

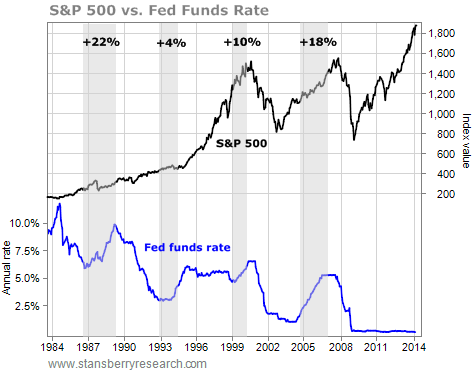

Finally, you only need to look at a long term chart to see the implications of higher rates. It’s pretty clear that stock markets can still climb as interest rates go up. Between 2003 and 2007, the S&P 500 gained heavily as interest rates moved towards 5%.

Historically, it is towards the end of the rate hiking cycle that is usually the worst time to invest in stocks. And of course, that is a long way away from here.

Understanding the Fed

So as usual, trading the stock market is never as simple as the textbooks like to perceive. Interest rate hikes bearish, interest rate cuts bullish? Well, not always.

It’s the little nuances that traders need to understand if they want to time the market on a short-term timeframe, and understanding the Federal Reserve is one of the most important things to learn at the present time.

Yes, there will come a time when the turning off of the printing presses will cause difficulties for stocks, but it is too early to say when that time will come.