The benefits of having a profitable trading system are clear. Wealth generation, freedom, reduced stress. But there are problems too, which most system developers sweep under the carpet.

In this post we will look at some of the disadvantages associated with trading systems.

1. Trading Systems Can Have Lengthy Drawdowns

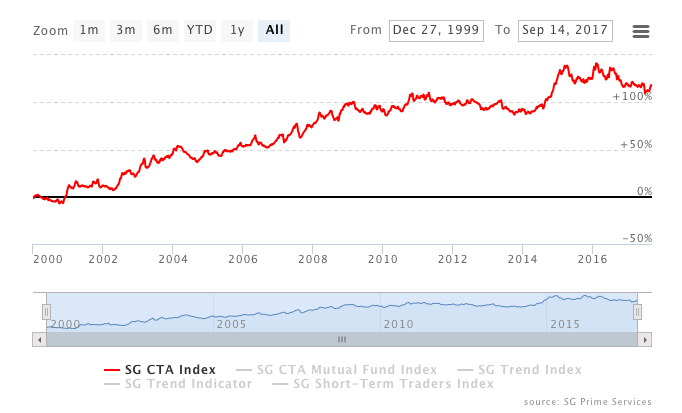

Unfortunately, it’s not uncommon to see a good trading system experience a long drawdown. That drawdown might last several months at a time. In fact, some well known trend following systems have been in a drawdown for 60 months.

System traders can avoid lengthy drawdowns by combining strategies together and including shorter-term systems that trade more often.

The more frequently you can trade your edge, the faster you can play out your expectancy and the quicker you can recover from any drawdown.

2. A Trading System Can Stop Working At Any Time

Since the dynamics of financial markets are always changing, there is no way to know for sure whether a system will carry on working tomorrow as it did in the past.

A freak event or even a subtle change in market conditions can render a trading system obsolete at any time.

The only solution is to work with probabilities. You cannot be 100% sure that your trading system will work tomorrow but you can have a degree of confidence.

3. Trading Systems Don’t Get Rid Of Emotions

A popular myth about system trading is that it cures the emotional side of trading thereby making trading more professional and error free.

Unfortunately, this is only partly true. Traders still look at their P&L when trading and therefore they still experience the emotions of losing and winning.

You can also transfer your emotions to a trading system in the development phase. For example, instead of listening to the data you program rules that fit your pre-conceived ideas about the market (confirmation bias).

That said, system trading is much less stressful than a pure discretionary approach.

4. You Cannot Rely Solely On A Backtest

There is no better way to find a trading strategy than through backtesting. But you can put in hours of work testing a trading system without knowing whether it will translate into real profits.

This is because there are many pitfalls and difficulties that get in the way of validating backtests. Curve fitting and look-ahead bias can easily creep in and modelling transaction costs and market impact is notoriously difficult.

This is why I recommend the system traders feedback loop where you build up a live sample of trades before taking too much risk.

System traders know the power of backtesting but they also know they can never be too confident in their system until they have seen it bring in real profits.

5. Trading Systems Can Increase Risk

Another frequently touted advantage of systematic trading is that it can reduce risk. This is also true but it depends on the system.

Good trading systems are usually relatively simple because this makes them easier to validate, easier to program and harder to break. However, simplicity can lead to increased model risk.

This is where a trading system is unable to model the complexities of financial markets perfectly. It is therefore susceptible to negative surprises that don’t fit the model.

You can also introduce risk if you implement trading automation poorly. Or if you give your system too much freedom.

One solution that system traders use is to turn their systems off when risks or uncertainties rise. For example, when you know a big event like Brexit is about to take place.

However, black swan events can hurt leveraged trading systems. This is what happened with Long Term Capital Management.

6. Trading Systems Take A Lot Of Effort

Getting to the point of being able to create profitable trading systems takes a long time and a lot of effort.

Usually, a trader must learn about many things such as coding, statistics, the dynamics of financial markets, the pitfalls of backtesting etc.

This process can take many years of hard work and perseverance.

Fortunately, learning these skills is well worth the effort and can enhance your career prospects too.

Once you are able to trade with a system, time becomes your friend not your enemy. You can sit back while your (discretionary) trader friends strain their eyes in front of the screen all day.

7. Trading Systems Can Cause Overconfidence

Another problem is putting too much trust into a trading system too soon. This can backfire spectacularly if your confidence is based on a faulty backtest.

Furthermore, just because you have found a profitable trading system does not mean you can ignore position control.

Even if you have a good system you will still encounter long losing streaks. Those losing streaks will send your account into free fall if you bet too much size.

8. You Might Not Be Able To Follow Your System

Often a trader will create a trading system and then deviate from it when it comes to real trading. This is linked to the fact that systems do not cure all the emotions from trading.

A six month drawdown where you lose 30% looks a lot easier to handle when viewed in the perspective of a ten year backtest. But the reality could be very painful and many traders will jump off their system when the going gets tough. This is could be the worst time to stop trading it.

To solve this problem, you need to be brutally honest with yourself and only develop trading systems you know you can follow.

9. Most Trading Systems Fail

Another truth that system developers rarely talk about is that most trading systems fail.

Some die a slow death from dwindling performance whereas others blow up in spectacular fashion.

The reality is that financial markets are extremely efficient and the competition from well-backed players and institutions is huge.

You need to stay on top of your game to succeed. It is not surprising that all trading systems will fail eventually.

10. You Will Never Find The Perfect Trading System

If you go in search of the perfect trading system you are likely to run into two major problems:

1. You will never be satisfied with what you have and you will spend all your time backtesting strategies and zero time trading. This is what I refer to as the ‘backtesting spiral‘.

2. You will only accept extremely high performing systems which are likely to suffer from curve fitting or some other bias.

Finding systems with robust edges and then using techniques to enhance overall performance is more important than finding the illusory perfect system.

Excellent post JB – thanks for sharing! These are good reminders that trading systems are not the be all end all of market success (although they sure can help)! Thanks again.

Thanks Jay