The uptick rule is a short selling restriction that says you can only short sell a stock on an uptick. In other words, you must wait for a stock to trade a tick higher before you can short it.

This rule was first introduced in 1938 to promote market stability and investor confidence. However, the rule has always had critics and was pulled shortly before the financial crisis in 2007.

In February 2010, the SEC introduced an ‘alternative uptick rule‘ which restricts investors from short selling a stock that has dropped more than 10 percent in one day.

This short selling restriction starts from the moment the stock has dropped 10 percent and lasts until the close of trading on the next day.

Again, the idea of this circuit breaker is to prevent unrestricted short selling from driving down the price of an already beaten down company.

Although the rule is intended to improve market stability, some critics argue it does the opposite by preventing natural price discovery.

Buying Stocks After A 10% Drop – The Alternative Uptick Rule

Since the alternative uptick rule restricts short selling after a 10 percent decline, it might seem a good idea to go long when the circuit breaker takes effect.

Uptick Rule Example

The following cherry picked chart shows a great example of this:

Veeco Instruments Inc. (VECO) fell 18.7% on the 8th December 2017. A short selling restriction would have then been applied. Going long on the next open and holding for one day would have returned a nice profit of 11%.

Uptick Rule Backtest Results

If short sellers cannot go short, and must first wait for longs, surely there is a good chance that the stock will rise in this situation?

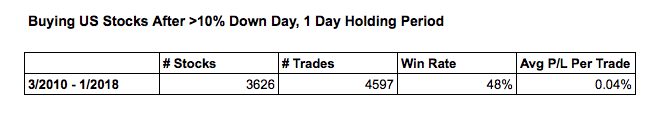

To test this theory, I ran a simulation on 3,626 US stocks between March 2010 (when the alternative uptick rule started) to January 2018 and found 4,597 times where a stock closed 10% or more below the close of the previous day.

In 2216 of those occurrences (48%) the stock moved higher the next day giving longs a profit. In the other 2381 times (52%) the stock carried on lower, giving a loss.

The average gain from winning trades was marginally larger than the average loss from losing trades resulting in a profit overall.

However, the average profit per trade is only 0.04% and this is before commissions and slippage.

This edge is not large enough to cover transaction costs and is less than the average daily return of all stocks in the sample (+0.07%).

In other words, the introduction of the uptick circuit breaker does not lead to a significant rally for stocks on the next trading day. This is not a worthwhile trading strategy.

Including Transaction Costs

As the following equity curve and profit table shows, the strategy of buying stocks after a 10% drop and holding for one day has been a consistent losing strategy once transaction costs ($0.01 per share) and portfolio settings are applied:

Final Thoughts

Buying a stock that has a short selling restriction sounds like it could be a logical strategy but the data shows that this has been a losing strategy in the US stock market after commissions.

It should be noted that just because new shorts are not allowed to enter the fray, there are still existing stockholders who may use the opportunity of the circuit breaker to sell their positions.

Short sellers are also able to enter trades on certain stocks and on any uptick so they are not completely restricted.

Overall, the evidence shows there is no edge from buying stocks after a 10% drop. If there was any profit, it is wiped out after transaction costs.

Next time you see a stock with a short selling restriction you can bear this in mind and think twice about going long.

Simulation and charts in this article from Amibroker using data from Norgate Premium Data.

Stocks were selected from the S&P 1500 universe with a minimum turnover of $500,000. Includes delisted stocks. All trades executed on market open price.