The best way to eliminate emotion and subjectivity from trading is to bring in rules that can be used to identify the best times to enter and exit from trading positions. The difficulty when implementing fundamental trading strategies is that obtaining historical, fundamental data for stocks is particularly expensive.

Fortunately, using the models at portfolio123.com (which uses data from a host of vendors including Value Line and CapitalIQ) it is possible to try out a number of fundamental strategies for a relatively low cost. Using this data we are able to test popular fundamental measures such as PE ratios, EPS statistics and debt calculations. These rules can be used to form a portfolio of stocks, rebalanced every 4 weeks.

An 8 Rule Fundamental Trading Strategy

The following strategy is based on 8 rules which can be easily calculated using the various financial statistics found in the financial papers or on online websites such as Finviz.com or Google finance.

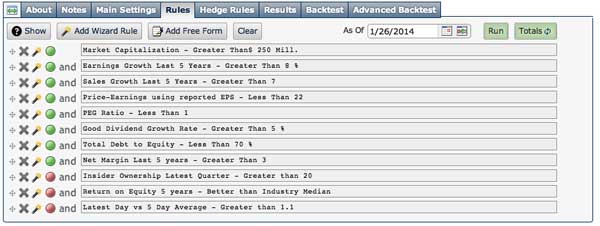

In order to test the system I logged into portfolio123, clicked on ‘Screen’ and then began adding the following rules. (This is made easy by the ‘Add Wizard Rule’ function and enabled me to enter all the rules in just a couple of minutes).

Rule 1: Market capitalization > $250m

(Because we want stocks that are big enough to trade and not illiquid)

Rule 2: Earnings growth over the last 5 years > 8%

(Because over 8% indicates a growth company with consistent performance)

Rule 3: Sales growth over the last 5 years > 7%

(Because sales growth combines well with earnings growth to find good growth companies)

Rule 4: PE < 22

(Because we want to eliminate all highly priced stocks that could be overvalued)

Rule 5: PEG ratio less than 1

(Because PEG is a good measure of price relative to growth. This is an important number that has a big effect on our results)

Rule 6: Dividend growth rate over last 5 years > 5%

(Because dividend growth is important for stocks with low dividend yields, this will eliminate around half of all stocks and has an important bearing our our results)

Rule 7: Total debt to equity less than 70%

(Lower debt is preferable but I kept this number fairly relaxed as many growth stocks perform well with relatively high amounts of debt)

Rule 8: Net Margin over last 5 years > 3%

(Keeping net margin greater than 3% will usually eliminate two thirds of companies with weaker sales margins)

Backtest results

To test the rules-based fundamental trading strategy I initially ran a backtest over the dates 1/1/2000 – 1/1/2005 on all stocks. As you will see from the chart below, the strategy performed well, returning 27.02% a year with a maximum drawdown of -29.19% and a sharpe ratio of 1.02. This compared with a -3.71% annual return in the S&P 500 benchmark index.

Buoyed by these results I moved forward and tested the strategy over the maximum data period available: 1/2/1999 to 1/27/2014. As the chart shows, the results were decent with a 15.02% annual return and sharpe ratio of 0.42. Thus, the 8 rule fundamental trading strategy seems to be able to find some excellent investing opportunities. Expanding on this system further, perhaps adding rules and introducing new filters and a ranking order may be able to improve its returns.

Limitations

While the 8 rule fundamental trading strategy is interesting, there are many limitations to this analysis. First of all, no commissions were included as portfolio123’s ‘Simulation’ model was not used. Slippage was set at 0.25% and carry cost at 1.5%. Furthermore, I do not believe delisted stocks are included in the analysis. However, from personal experience I doubt that including them would have much of an impact.

Today’s 8-Rule Stock Picks

Now the 8-rule fundamental trading stategy has been backtested, these are the stocks that currently meet it’s criteria:

Fundamental analysis techniques and technical trading systems and code are included in my new book which is out now, heavily discounted for a limited time period: