I don’t do much day trading anymore as it’s incredibly difficult to find profitable intraday trading techniques.

For one thing, it’s very hard to compete against all the algorithmic machines, banks, and high frequency traders.

For another, I prefer to trade mechanically and it’s almost impossible to come up with a profitable intraday trading system. Once commissions and slippage are taken care of, most intraday trading systems fail. And even if you do find an edge, it usually won’t last long.

Because of this, I believe it’s better to use mechanical trading systems on longer timeframes. For shorter timeframes, I believe traders are best advised to utilise both a mechanical and discretionary approach.

You can use a profitable or break-even trading system as a base, then use your experience and intuition to choose the best trades to take. I call this approach ‘teaming up with the robots‘.

Because, if you can combine the human mind with the computer, it gives the best chance of success. (And this is how humans were able to beat some of the most sophisticated computers playing chess).

This is the essence of how I trade and I maintain a number of short-term and long-term trading systems which I use to manage my portfolio. These strategies have been tested on historical data and work during different types of market conditions. As well as this, I keep a separate pot of capital available to capitalise on short-term, intraday opportunities when they arise.

What I never do anymore is watch the screen all day. I simply don’t enjoy watching price charts move for hours and find this an immense waste of time. Especially when there are so many more fulfilling things you could be doing with your life. That’s why I use these trading systems and I spend less than an hour each day updating and organising my trades.

Chart reading is a skill

But don’t get me wrong, chart reading is a definite skill and if you want to be a good day trader, then you will definitely need to put in some serious screen time. It takes a lot of practice to become adept at reading charts and I believe the most important aspect of this is watching how the charts react to certain events. This is what I have had the most success with during my time, and in my mind, this is the key behind predicting future price moves.

But now let’s get into my four favourite intraday trading techniques. These are the ones I’ve had the most success with in the past:

Intraday Trading Techniques

1 – Pivot levels

Before I worked at a trading firm I had never heard of pivot points but these days I think most traders know about them.

Pivot levels go right back to the days of the trading floor and before the decimalisation of securities but they’re still used today by lots of intraday traders.

Because so many day traders and ‘locals’ look at pivot levels, they provide excellent levels of support and resistance in the market. Everyone is looking at them which means they are more likely to provide significant turning points. They have a simple calculation which is calculated using yesterday’s prices and this means that the levels constantly adapt to the market.

I’ve worked at two day trading firms now and in both companies, traders would look at pivots. Even if they didn’t directly trade off pivots, all the traders had an idea of where they were and what could happen when a pivot point was approaching.

How to use pivots intraday

Always remember that the pivot is the most important level. When the market is above the pivot it’s a bullish signal and when the market is below the pivot, it’s bearish.

Accordingly, some traders will only buy when the market is above the pivot, and they will only take short trades when the market is below the pivot.

The other support and resistance levels are usually very good levels to take profits and manage the trade.

Occasionally, when the market is particularly overbought or oversold (look for a high RSI or momentum score) the levels can be used to take reversal trades.

Pivot level Example

Take a look at this recent example in EURUSD. You can see that the market touches the key pivot levels regularly; pivot, R1, R2, S1 and S2 particularly. Traders know where these levels are so they often take their profits and make their trades around the same place.

*Charts courtesy of IG Index.

One strategy? Buy when the market pushes through the pivot with conviction then take half of your position off at R1, and try to sell the rest at R2. You can keep your stop below S1, and use the distance between S1 and your entry to calculate your position size (based on an attractive risk:reward ratio).

For example, if the difference between your entry and S1 is 30 pips, you could make your profit target 60 pips away, looking for a 2:1 risk:reward. You can use the levels to further fine tune your best exit points.

Also, keep an eye on momentum and other indicators like RSI, moving averages and Bollinger Bands. As you can see from the next chart, if RSI is overbought and the market is at a resistance level (like below) that’s going to be a good time to sell. Similarly, if RSI is oversold and the market is at a support level, that’s an extra reason to buy.

In another article, I look at pivot points in depth and I test these levels using historical data to see if a good trading system can be developed. Check it out when you have the time.

2 – Trading The News

Another effective method for intraday trading is to trade news releases and economic reports. When a positive piece of news comes out you want to buy the market and when a negative piece of news comes out you want to sell.

Of course news trading isn’t as easy as it sounds, especially when you’re a retail trader and banks and hedge fund traders have access to all the quickest news feeds and inside sources. High frequency trading (HFT) algorithms, for example, are able to analyse and react to economic reports in a split second, making it impossible to compete.

The solution then is to stick only to the biggest news releases that actually move markets and to use your intuition to take the best risk:reward positions.

In some cases you may want to take a position before the news item comes out. That way you may be able to manage your trade and get in before the move. Again, it’s not easy but big profits can be made if you get on the right side of the trade, as proved by these traders who gained illegal access to economic statistics and made millions.

All about probabilities

Predicting the outcome of economic releases or earnings reports might not be possible but it is possible to analyse price action and to make careful risk-based bets.

For example, if a strong, positive, piece of news comes out and the market struggles to go up as it should, that’s an important sign that should be taken account of.

In this instance, price action is suggesting that there are not enough buyers, even though the market has just had good news. That means resistance, and when the good news wears off, or when bad news comes out, the market could easily fall.

Being able to interpret price action in relation to events is absolutely key.

Just recently, US non-farm payrolls came out worse than expected but the market barely budged. Why? Because there simply wasn’t enough sellers to take the market lower. Markets take the line of least resistance, so when the bad news had been fully absorbed the market ended up going higher.

Which news releases to watch for intraday trading

Plenty of news releases have no effect but the best news releases for futures traders are listed below:

– Non-farm payrolls (Average USD pip movement of 100-150 pips)

– Central bank announcements (interest rate decisions especially)

– Retail sales (Average 80 pips)

– US Trade balance (Average 70 pips)

– US CPI (Average 70 pips)

The key with news trading is not to follow market sentiment; you need to work out what the market is expecting and if need be take a position against the crowd – if the probabilities are in your favor. For example, if the market is pricing in a 70% chance that the Fed will raise interest rates and you make it to be just a 25% chance, then going against the market offers a trade with great risk:reward.

News trading can be profitable but generally it requires quick thinking and a bit of preparation. Whatever it is, it’s always best to try it out for a while on a trading simulator.

Quantpedia

If you are interested in more news and event-driven strategies you may want to check out Quantpedia which has a database of over 200 quantitative trading strategies for stocks, currencies and futures. There are strategies based on events as well as longer-term methods and this is one of my favourite resources for finding trading ideas.

3 – Scalping

Scalping requires skill but is one of the most popular intraday trading techniques. The scalping method is to take lots of trades with short holding times, hoping to capture one or two pips here and there, building them up as you go.

Increasingly, traders use algorithms to calculate minute inefficiencies in the market and scalp a couple of ticks here and there, particularly in the forex markets. It goes without saying that scalping requires extremely tight spreads, a lot of practice and a lot of skill.

If you get involved in scalping it’s also a good idea to sign up with a rebate company as you can get back some of your commissions that way. But I would certainly stay away from any intraday trading system that claims to scalp the markets as it’s probably not true.

I’m not a huge fan of scalping as it’s generally a technique that requires a lot of screen time and discipline. It’s not uncommon to see scalpers build up a month worth of profits and wipe them all out on a couple of moments of weakness.

4 – Unforeseen events

Often, short-term trades are no better than a coin flip and you would have just as much success going to the casino and betting on black at the roulette table.

However, another time that I will engage is if I see an opportunity come up that is too good to miss.

For example, maybe a stock has been sold too aggressively on a bad earnings number, or maybe there’s been a natural disaster, or a shock event. There are opportunities in these trades but they don’t come around that often.

They usually involve a great amount of uncertainty and emotion. So the key is usually to take a contrarian position (trade the other way to everybody else) then stay disciplined and try not to budge.

Examples

For example, the massive sell-off in USD/CHF in January 2015 when the Swiss national bank removed exchange controls against the euro and the franc rallied by historic proportions. This was an unforeseen event that caught many forex traders by surprise and sent some forex companies into liquidation.

But as you can see from the chart, there was also a massive over-reaction (due to forced selling) and taking the opposite side of the trade the very next day would have been the perfect time to buy. As is clear, markets often overreact and it often pays to go the other way.

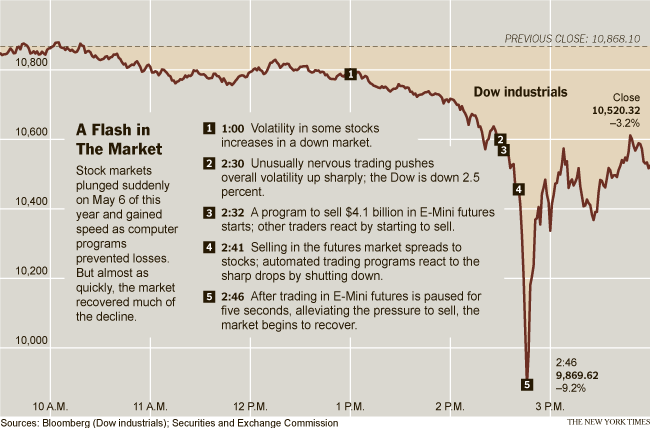

As another example, remember the flash crash of 2010 when the S&P 500 dropped almost 10% in a matter of minutes. This would have taken out many traders but if you were alert and on the sidelines, you may have been able to jump in and make a quick profit when the market rallied off the seemingly oversold position.

Finally, here’s a chart of the Japanese Nikkei after the tragic earthquake and tsunami in 2011:

At the time, there was widespread panic, devastation, chaos, and everyone sold their Japanese holdings out of fear. It’s not nice to profit off of a natural disaster, but if you had said at the time “I think this is a bit overblown, I think Japan will be alright” you would have made money buying the dip. And in a way, you would have helped support the country in it’s time of need.

Looking back, the Nikkei did end up revisiting those lows but at the time of the disaster, there were fast profits available for intraday traders reacting to events.

Additional resources

– See my post: 20 day trading strategies for beginners for even more intraday trading ideas.

– See an example of an overnight trading strategy.

– You may also like my list of the best trading courses for beginners.

Please consider sharing this if you found it useful and sign up for my mailing list to get updates and discounts.

good

Appreciate for your great observations. I agree with Pivot points. Do you think that applies to all US traded assets mainly a few currency pairs and indices, perhaps key commodities?

Your valuable ideas are truly appreciated.

Great techniques that can eliminate the risk.

Please let me know if you’re looking for a author for your site.

You have some really great posts and I think I would be a good asset.

If you ever want to take some of the load off, I’d really like

to write some material for your blog.

Please send me an email if interested. Cheers!