Because financial matters are rarely covered during high school, many people don’t understand the stock market or how to invest their money properly.

This means that they are more vulnerable to investment scams. With the growth of the internet, and the current frothy state of global markets, these investment scams are unfortunately all too common.

So here are a list of 20 common traps that all traders and investors need to be aware of:

1) Ponzi Schemes

Ponzi schemes involve a cycle of using new investors money to fund the returns of existing investors.

Eventually, the money runs out and the whole operation unravels.

When you think of Ponzi schemes your first thought is probably of Bernie Madoff. But Ponzi schemes are more common than you might think and there have recently been a number of cases in the forex space.

Warning signs to look out for:

- Returns that seem too good to be true.

- Almost no losing trades/months.

- Long lock-up period on investment (for example not being able to take out your money until several years have passed).

2) Penny Stocks

According to the SEC, a penny stock is any company that trades for under $5 a share. These stocks are typically high risk because of lack of liquidity, wide trading spreads and/or lack of information.

Because of a lack of liquidity and regulation, penny stocks can be fertile ground for investment scammers operating schemes such as front running or stock promotion (pump and dump) scams.

Not every penny stock is a fraud and some are legitimate companies with potential. The difficulty for investors is deciphering which are bad and which are good which can be like looking for a ‘needle in a haystack’.

Warning signs to look out for:

- Returns that seem too good to be true

- Companies that run frequent stock promotions

- Companies with no regulation or financial reporting

- Marketing that is full of hype and nothing substantial

3) Boiler Room Scam

The boiler room scam can be witnessed in the films Boiler Room and Wolf of Wall Street. Typically, it refers to a call center type operation where salesmen use dirty tactics to sell poor (or imaginary) investments (often penny stocks) to unwitting investors.

Warning signs to look out for:

- Salesmen trying to get you to invest over the phone

- High-pressure sales tactics, “limited time” opportunities

- Unlicensed brokers, firms located abroad

- Returns that seem too good to be true

4) Newsletter Scam

Operators of the newsletter scam send out investment reports/emails to a large group of people in the hope that at least a few will see mind-boggling returns and then decide to put their money into the service.

It works like this: the operator sends an email out to 20,000 people but half are told to buy and half are told to sell.

When the outcome is known, half the audience will have won and half will have lost. The operator then sends out another 10,000 emails (with two recommendations) but only to those people who won.

Another day ends and out of those 10,000, there will now be 5,000 who have received two winning tips in a row. This cycle repeats.

Depending on the scale of the operation, there will come a point where a handful of people have received numerous winning tips in a row and they’ll be tripping over themselves to subscribe to the paid service.

Of course, as soon as they subscribe to the service they will lose money on these random tips. This is a scam that has been going on since the times of Jesse Livermore.

Warning signs to look out for:

- Newsletters with poor reputation or lack of history

- Small sample size of investment results

- Investment strategy that lacks credibility

- Returns that seem too good to be true

5) Demo Trading Scam

Another trap to look out for are services from those demo traders who do not trade real money but instead execute all their signals on a paper or demo trading account.

The problem with following these types of traders is that their trading has not been subjected to real trading conditions. Demo trading results usually do not account for bid/ask spreads, fees, commissions, slippage and other factors. These factors can easily destroy the profitability of a demo trader.

Often, demo traders will use their paper trading results to convince unsuspecting victims to subscribe to their service or newsletter.

Warning signs to look out for:

- Lack of verified or audited results

- Lack of commissions or slippage in trading results

- Returns that seem too good to be true

6) Dishonest Brokers

Unfortunately there are also numerous cases of fraud stemming from dishonest brokers and trading platform providers. Some of which have caused the complete loss of individual investment accounts.

In the past, fraudulent brokers have manipulated prices and spreads, committed front running, prevented customer withdrawals, gone bankrupt, stolen funds and countless other scams.

Warning signs to look out for:

- Poor financial condition of broker

- Unregulated, lack of information and history on the firm

- Firms located in non-typical areas, foreign countries or tax havens

7) Snake Oil Salesmen

As I said at the beginning, the internet has made it a lot easier to commit investment fraud and so you need to keep alert to snake oil salesmen who can be persuasive and charming.

Investing fraudsters will often shout out loud about their performance and attempt to seduce you with portrayals of material wealth.

But in my experience, the best traders and trading mentors are normally found behind the scenes. They usually do not have flashy websites or thousands of twitter followers because they are too busy working on their trading.

They also know not to shout about all the money they just made because they know they could lose it just as quickly. And just because a guru has written a trading book does not mean they are legit. Product reviews are very easy to game even on sites like Amazon.

Warning signs to look out for:

- Salesmen that prey on emotional response rather than detailing the substance behind a product

- Over the top marketing of material wealth through social media such as Instagram

- Marketers who are always latching on to the ‘next big thing’

- Unusual statements/wording in online disclaimers

- Returns that seem too good to be true

8) Black Box Trading Systems & Indicators

We have several trading systems documented on our site but they all come with original source code and with a strong risk warning – past performance is not indicative of future results.

In other words, just because a trading system made money in the past doesn’t mean it will continue to do so in the future.

Moreover, as a system trader you can never be 100% confident in any trading strategy because the future is never known.

However, the internet is full of trading systems that do not have any such disclaimer and instead promise huge returns with little risk.

There actually are profitable trading strategies to be found online but they are few and far between and investors should nevertheless always try them on paper first before committing real money.

Warning signs to look out for:

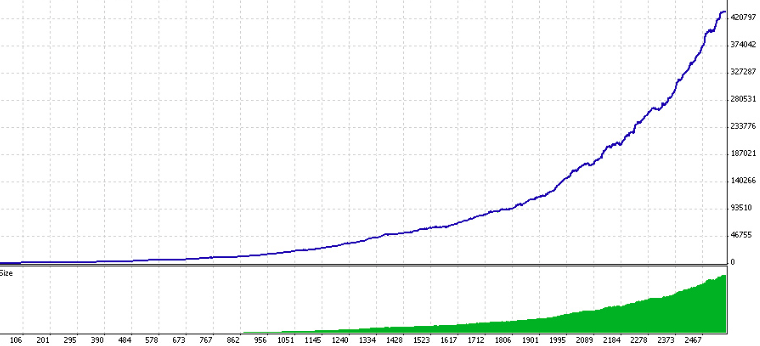

- Upward sloping equity curves shown with very little drawdown

- Unrealistic win percentages and drawdown levels

- Lack of information about rules and source code

- Returns that seem too good to be true

9) Expert Advisors

An expert advisor is technically no different to a trading system but because there tends to be a lot of fraudulent EA’s out there I thought I would give it it’s own heading.

Expert advisors are predominantly found in the forex space and used in tandem with MT4 to trade currencies on short time frames.

Maybe there are some profitable expert advisors out there but the vast majority are losing systems after commissions. Even so, there are numerous fraudsters claiming to have gotten rich from their methods and they market them blatantly on the internet.

Warning signs to look out for:

- Upward sloping equity curves shown with very little drawdown

- Unrealistic win percentages and drawdown levels

- Lack of information about rules and source code

- Returns that seem too good to be true

10) Trade Copying Websites

In recent times there has been an explosion of trade copying websites and services (for example eToro and ZuluTrade) which allow anyone to follow the trades of others and even auto trade their signals.

As with most items on this page, there may be a handful of good traders on these sites. But picking them out from the cesspit of losing traders and fraudsters is next to impossible.

The big problem with these sites is that the traders on top of the leaderboards have very often got there through luck alone or through dodgy risk management.

If you have a large enough database of traders then there are bound to be some winners and they will look convincing enough to beginners.

Inexperienced traders latch on to the winners (instead of looking for the most consistent, conservative traders) and then they lose money when that trader inevitably blows up.

Warning signs to look out for:

- Trade ‘leaders’ with unrealistic equity curves and short history of results

- Trade ‘leaders’ that use ill-conceived trading methods such as martingale position sizing and grid trading

- Services that promise easy gains and returns that seem too good to be true

11) Binary Options

Binary options are not a complete scam in themselves. After all, there are some binary options products listed on the CBOE.

However, like penny stocks and expert advisors, binary options provide fertile grounds for scammers due to lack of regulation and ease of entry. In fact, the FBI estimates that binary options scams are used to steal $10 billion a year worldwide.

Two questions to ask before trading binary options are:

1) Is the broker regulated and legit? Otherwise the whole setup could be fake and designed to take your money.

2) What is the payoff on the trade? Payoffs can range from 60% (worse than a fruit machine/ one-arm bandit) to over 90% (much better).

12) Bubbles And ‘The Next Big Thing’ Scam

Thanks to excessive money printing from the Federal Reserve there is an unprecedented amount of money sloshing about the financial system in 2017.

This money is making it’s way into new financial bubbles and simply making it easier for financial fraudsters to operate new scams.

The latest craze is bitcoin and cryptocurrencies which have seen incredible price rises on the back of speculation and human greed.

Initial coin offerings (where new ‘currencies’ are initiated in order to fund real investment projects) have been singled out as a major fraud and there are now thousands of different coins in circulation.

Actually, the amount of crap coming out about cryptocurrencies on a daily basis is disturbing and getting out of hand.

I have seen numerous cowboys offering cryptocurrency products and services promising huge returns with zero risk and without any disclaimers. This is often not legal in other asset classes and will need to be clamped down upon at some point. The fact is that many people are going to lose a lot of money from these services.

At the end of the day, the time to invest in such ventures as bitcoin is when it is relatively unknown to the general public, not when it is being talked about on every major news channel. Even then, it is best to invest carefully and gradually, not to jump in with your whole savings.

Warning signs to look out for:

- Asset classes that have seen unprecedented price growth, primarily on speculation

- Asset classes that are being discussed daily by major news channels and the public

- Asset classes that promise the ‘next big thing, huge returns with little risk’

- Returns that seem too good to be true

Harder To Spot Traps

Now we have talked about some of the big investment scams and traps that you should avoid, I’m going to go over some more subtle ways you can trip up on your way to investing riches.

13) Repainting Indicators

Have you ever come across a technical indicator that manages to predict every twist and every turn with incredible accuracy?

One reason why the technical indicator might work so well is that it could be what’s called a repainting indicator.

Repainting basically means that the indicator recalculates itself after every price bar. This means that it’s historical values can change after each bar and so you can’t make reliable trade decisions based on those historical values.

A good example are Renko charts. Renko bars tend to rebuild themselves after a change in trend. Unlike moving averages, for example, which keep their fixed historical values.

This means that when you look at a Renko chart in two weeks time it often looks completely different to how it does today.

This can be a particular problem for system traders because if you backtest with a repainting indicator you are likely to get extraordinary results that can’t be replicated in real trading.

Warning signs to look out for:

- Indicator’s historical values change on every bar

- Unrealistic and extraordinary results in backtesting

- Returns that seem too good to be true

14) Wall Street Scams

Another trap that is easy to fall into is simply sending too much money Wall Street’s way.

Every time you make a trade or buy some financial product, someone on Wall Street is undoubtedly making a profit off of you.

So do your best not to overtrade. Don’t bet too often and shop around for the best commissions and the best fees. Don’t pay 5% annual fees on a fund that you could pay 0.3% on with an ETF.

Furthermore, be aware of the impact of decentralised stock exchanges, dark pools and the impact of high frequency trading. As was detailed in Michael Lewis’s book Flash Boys, high frequency traders have been accused of front running and buying customer orders in order to profit.

Warning signs to look out for:

- Brokers that make money from commissions (mixed incentives)

- High fees on funds that could be easily replicated

- High costs and slippage on trades

- Noticeable movement in price after you hit trade

15) Small Sample Sizes

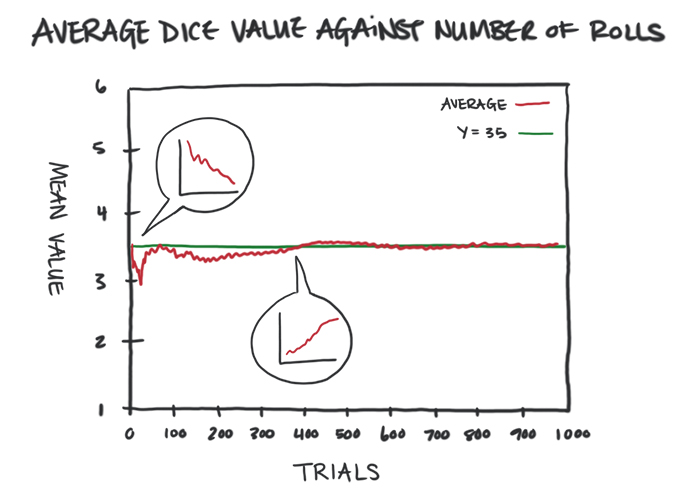

A trader can avoid a number of the financial traps on this page by understanding the law of large numbers and how it impacts investment results.

Understanding this basic law of statistics can help you to avoid making decisions based on small sample sizes.

For example, investing your money in a fund manager with a tiny track record. Or trading a system that has a backtest record of only 10 trades.

The more data you have available, the less luck (random noise) is present in your results and the more confident you can be in your analysis.

Investors should also be aware of the issue of selection bias. If you test enough strategies you are bound to find a good one through luck alone.

Warning signs to look out for:

- Investments that have short historical record

- Strategies that have short historical records of actual trades

- Small sample results that do not conform to common sense principles

16) Human Bias/Errors

As humans, we have a number of in-built biases which can cause havoc with our trading and I talk more about these in my course on Mental Models.

One of the biggest problems for investors is the hindsight bias. This is where you think something in the past was more predictable than it was at the time and so it causes you to calculate probabilities poorly.

Another big problem is the availability or recency bias. This is where we place too much emphasis on recent data when coming to a decision instead of looking at the bigger picture.

For example, you might encounter five losing trades in a row and come to the conclusion that your trading strategy is broken.

However, if you looked at all the data you might see that five losing trades in a row was perfectly normal and happened many times in the past for that type of system.

Warning signs to look out for:

- Trading based on gut and without a plan

- Non-business like investing, not quantitative

- Relying on basic emotions and small sample sizes

17) Future Leak

This is a trap that is particularly relevant to systematic traders and backtesting.

A future leak occurs when you backtest a trading system and somewhere along the line you incorporate future values into your analysis and therefore drastically skew your results.

A common example is when the system enters on the open of a bar based on an indicator that uses the close price of the bar. This means you are trading ahead of your signal and therefore you’re likely to get a better than realistic backtest result.

Future leak can occur in more subtle ways as well such as using the wrong amount of equity that would be available for your system.

Another example is trading a universe of stocks (such as the S&P 500 universe) and not incorporating delisted stocks thus introducing survivorship-bias.

Warning signs to look out for:

- Unrealistic equity curve with very little drawdown

- Trading metrics that seem unrealistic

- Returns that seem too good to be true

18) Overfitting Problem

Overfitting is another trap related to systematic trading but also has relevance to the wider investment audience.

The financial press frequently commits overfitting errors and other statistical errors when talking about trading strategies and investment performances for instance.

It can occur when system developers, analysts or writers place too much faith in weak data correlations. For example, believing that just because a stock ‘always’ goes up in January, it will keep doing so.

‘If you torture the data for long enough it will eventually confess to anything.’ See data torturing and Fooled by Randomness.

But future predictions can never be made with certainty and overfitting is hard to avoid. The best way to overcome this problem is with common sense reasoning, using larger sample sizes and other statistical methods.

Warning signs to look out for:

- Small samples sizes that lack statistical significance

- Correlations that lack common sense and basic reasoning

- Returns that seem too good to be true

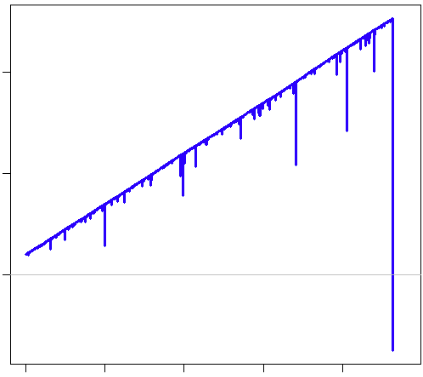

19) Martingale Position Sizing

The way martingale position sizing works is that whenever you lose, you double your position size. In a game of random chance you will eventually hit a winner and thus recoup all your losses plus a bit more.

In trading, martingale can involve buying a market at lower and lower prices hoping that it will eventually go back up. (This is not be confused with dollar cost averaging which can be an effective investment method).

Although it sounds good in theory, in practice martingale always leads to a blow up. This is because it relies on you having an unlimited bankroll or that you are trading a market with unlimited liquidity. Losing streaks can continue well past the size of your bankroll.

Actually, some market makers and brokers are able to put limits (margin calls) on an account that can further limit position size and reduce the effectiveness of the strategy.

Warning signs to look out for:

- Unrealistic equity curve with barely any drawdown

- Unrealistic win rate such as over 90%

- Excessive averaging down on positions and taking increasing risk

- Returns that seem too good to be true

20) News Based Scams

The news based scam occurs when fraudsters latch on to the latest news event or development in order to profit from fake companies, products or services.

When the Zika virus first hit, a number of fake companies popped up that claimed to be researching potential cures. These claims were used to lure naive investors into purchasing stock.

The same thing happened with Ebola, with cryptocurrencies and various other news stories. As can be seen, the imagination of financial scammers knows no bounds.

Warning signs to look out for:

- Dubious looking companies with little history or regulation

- Poorly designed websites and investor materials

- Products, companies that are new and latching on to recent news events

- Returns that seem too good to be true

Final Thoughts

Unfortunately, the financial sphere is littered with landmines that can destroy your wealth and set you on the wrong path. There are probably many other scams out there that I haven’t included in this list.

The overwhelming message from all of these scams, however, is that if something looks too good to be true, it usually is.

There are very few shortcuts in the investing world so make sure you stay smart and diligent to protect your hard-earned cash.

The best way to avoid these traps is to use common sense and treat your investing like a business. Stay disciplined and quantitative and don’t give in to greed.

I hope you found this useful and that it helps you stay away from some of these common scams!

Great article! The Newsletter Scam is something familiar to British I think, because it was done with gambling by Deren Brown I think

Oh really, I didn’t know Derren Brown had done something with that. It’s quote an old fashioned scam that has been around a long time that one

Put simply, don’t fall for it! If it seems to good to be true, it probably is!