According to a recent study from UBS, millennials are more risk-averse than other generations that came before them. Whereas millennials typically hold 52% of their savings in cash and only 28% in shares, other generations (such as Baby Boomers) are the reverse, holding just 23% in cash and 46% in stocks.

This flies in the face of traditional investing wisdom that suggests you should hold a greater percentage of stocks when you are young and diversify into safer investments as you age. When you are young, you have more time to recoup losses, therefore you can afford to take on a little more risk. But right now, millennials are in many cases too afraid to invest in stocks.

And who can blame them? The current generation is still scarred from the deep losses from the dot-com bubble and 2008 Great Recession. Millennials are more concerned with job stability and protecting wealth rather than growing wealth and on a century long scale of conservatism this places them more in tune with the WWII generation, those who lived in the aftermath of the Great Depression.

Img src: UBS

Looking at the numbers, it might be reasonable to think that this is a rather sad development. Scarred by the losses of recent times, millennials are missing out on the opportunity to make their futures more secure. After all, stocks have been the best performing investment class over the last 100 years, and to ignore them is likely to have negative implications on future wealth.

Of course, another problem that millennials face is an apparent overload of information. Many simply do not understand the financial world very well and they feel overwhelmed by all the different investment choices that are available.

Fortunately, safe investing can be extremely simple and rewarding so long as you stick to some key principles.

With that in mind, here are my 6 steps for safe investing in stocks and bonds:

Step 1. Pay off your debts

Before you even think about investing in stocks you will need to make sure your financial situation is in good shape. While it’s OK to have some low-interest debt repayments such as on student loans or on a mortgage, you will want to pay off all of your high-interest debts, such as those on credit cards and other short-term loans. Few investments will pay off as well as the savings you’ll make from eliminating your high-interest debts.

Step 2. Get Free Money

The second step to successful safe investing in stocks is to take advantage of any existing 401k or pension plan that you may be eligible for from your employer. Such plans allow you to automatically invest a portion of your pay-check (before taxes) and have your employer match your contributions. This is essentially free money so should be taken full advantage of. Savings in 401k’s (and other schemes) will grow tax free until retirement, giving you a nice nest egg once retirement comes around.

Step 3. Put Some Money Aside

Your employer may not offer a 401k or pension scheme, or you might be self-employed. If that’s the case (and even if it’s not) you’re going to want to save up a bit of money first before you even consider investing.

A good rule of thumb is to make sure you have enough saved up to cover 6 months without wages. That will ensure you can still get through difficult periods of sudden unemployment or unexpected illness.

Step 4. Learn The Basics

Once you have your everyday financial situation sorted and you have a little left over to invest it’s time to learn a little bit about the financial landscape. Learn a little about stocks and bonds and the various other asset classes and get an idea of the expected long-term returns from each one.

Then, do a simple calculation. Subtract your current age from 100 and get ready to invest that percentage in stocks and the rest in bonds. So, a 30 year-old would put 70% (100-30 = 70) in stocks and 30% bonds. (Note, as people live longer some financial advisors are now using 110 or 120 instead of 100).

In May 2013, Money magazine recommended the following stock-bond ratios:

- Age 25 to 34: 80% stocks-20% bonds

- Age 35 to 44: 70%-30%

- Age 45 to 54: 60%-40%

- Age 55 to 64: 50%-50%

Step 5: Invest In A Diversified Portfolio Of ETFs And Index Funds

Now you have your finances sorted and you know your optimal portfolio allocation, it’s time to put your money to work. And it’s here where things can get either supremely complicated or kept incredibly simple – I recommend the latter.

There are countless books, articles, blog posts, and videos out there that attempt to foretell the secret to successful investing, (you could use fibonacci ratios, PE ratios, moving average crossovers, balance sheets or listen to company rumours…) BUT for safe investing, the majority of these strategies should be ignored.

And after reading step 6 (next) you will soon realise that you shouldn’t try to beat the market but to participate in it. And the best way to do that is by investing in a diversified portfolio of low-cost ETFs and index funds.

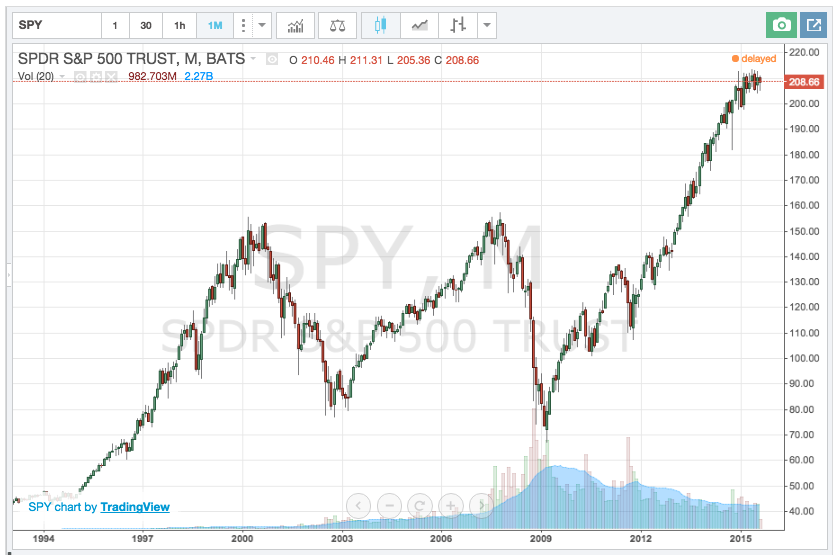

At the most simple level, and using the same portfolio allocation mentioned above, a 30-year old could invest their 70% into the S&P 500 ETF (ticker symbol $SPY). They could put their remaining 30% into the iShares 7-10 year Treasury Bond ETF (ticker symbol $IEF).

SPY is a low-cost index fund (with an expense ratio of 0.09%) that tracks the S&P 500 (a stock index made up of 500 of the largest US companies). IEF is a low-cost fund that tracks the Barclays Capital US 7-10 Year Treasury Bond Index.

This simple, low cost arrangement, would guarantee an easy and effective way to participate in the market, where 70% is in a diversified selection of 500 US stocks and 30% is in US government bonds.

Switching it up

Of course, depending on your geographical location, outlook, and risk tolerance, you may want to switch it up a little. If so, you could consider ETFs such as $URTH (the iShares MSCI World ETF), or $EFA (which gives exposure to over 900 companies in Europe, Australia, Asia and the Far East).

There are many different options available and millions of potential combinations

For a full list of the most popular ETFs (by trading volume) see here.

Such choice may not necessarily be a good thing.

There is no point in trying to build elaborate portfolios, trading in and out, or attempting to time the market. Remember to keep things simple, diversified, and low cost. Once your money is in the market, leave it alone to do it’s work.

Step 6: Participate In The Market: Don’t Try To Beat It

As I alluded to in the previous step, you should almost certainly forget about trying to beat the market. Why? Because you will almost certainly fail to beat the market over any long period.

Individual investors have been shown to be notoriously bad at investing. While the stock market has averaged annual returns of 9%-10% over the last 100 years, individual investors have managed to achieve just 1.9% a year.

That’s pretty terrible. But it gets worse. Because it’s not just Joe Public that fails to make good stock picks. Even professional fund managers fail to beat the market consistently. As you can see from the following table from Standard & Poors, over 75% of professional funds were unable to beat the performance of the S&P 1500 Index over the last ten years.

There are many reasons for this continued underperformance but the main one is that stock markets are relatively efficient (and becoming more efficient all the time). It’s therefore getting harder and harder to outperform the market, and when a manager does outperform, there is little evidence to suggest that they did so by any other means than sheer luck.

Using the approach as mentioned above ensures you will be able to reap the rewards from participating in the market, instead of risking underperformance by attempting to beat it.

Lump Sum Or Regular Investing?

So far, the assumption has been that you want to invest a single lump sum of money. In this situation, buy-and-hold on a diversified portfolio of funds will be most investors best bet. The good news is, even if you don’t have a lump sum, you can still utilise the same approach by way of dollar cost averaging.

By dollar cost averaging, you make regular investments into an ETF like SPY each month at very little cost, thereby gaining exposure to the same type of returns as you would through buy-and-hold.

If you invest regularly each month, market timing becomes a non-issue. When the market is down (like in 2008) you get loads more shares for your money and when the market is up, you’ll buy fewer shares. This all smooths out making this an ideal way for safely investing your monthly salary and building up a very healthy nest egg.

So whether you invest a lump sum, or your monthly salary, both can be done simply and safely.

Some More Handy Tips

Below are some more handy tips for investing safely in stocks:

• Don’t put all your eggs in one basket

• Beware of hype and promises that are ‘too good to be true’

• Beware promises of ‘guaranteed returns’

• Be extra diligent of new or ‘alternative’ investments

• Understand fees and expenses and their impact on your portfolio

• Always research investments and make sure they are regulated

• Consult a professional if you are unsure; make sure to check their background

You may also like:

– Motif Investing Review

– Using DCA to pick stocks at random

– Value Investing System: How to Find Cheap Stocks

I like the idea of investing in diversified portfolio. It will less expose you in future risks.

This post is packed full of great investing advice. Great detailed steps to make sure you won’t loose the farm! Not sure if I have ever seen such in-depth details on how to safely invest.

I have done very little investing thus far, but with this instruction, I think I will go after it. I will take your advice and pay off the remainder of my debt first, this makes a ton of sense.

Thanks for putting together this great article. I will be back.

Also, thanks for the free $149 training tool kit and course. Great info in that also. Thanks!

Thanks for your comment Charles, glad you found the post useful.